Most of us have a job. Some of us get paid really well and some do not. But the difference between someone making six figure income and someone making minimum wage is not what most of us would which would be too obvious, and it would be their income of course.

I beg to differ though because you see, the difference between someone making six figure income and some making minimum wage should be how much each of them actual keep in for their saving and investments.

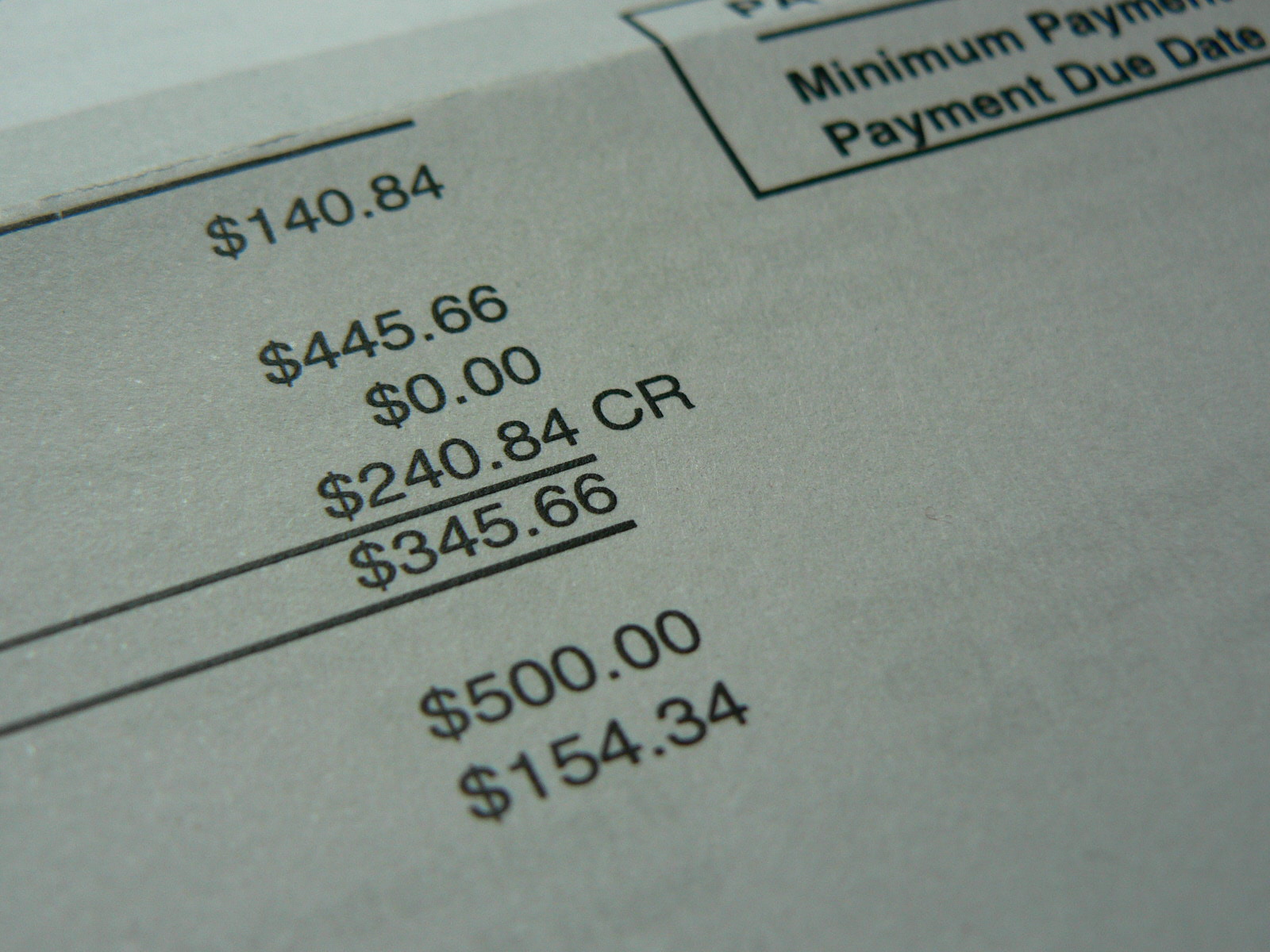

Let’s take for example someone who’s making $200,000 a year and a guy making $16,000 a year. If the person making 200,000 per year has expenses for $195,000; therefore manage to save only $5,000 per year. What if the guy making $16,000 per year, but his expenses is only $10,000 per year; therefore he manages to save $6,000 per year. The guy making $16,000 per year actually earn more money than the guy making $200,000.

Saving money is not about your income, but it is about discipline and habit. I challenge you this April which financial literacy month to get started. Keep in mind that it is not about how much you save. It is rather about developing a habit of saving. Even if you start saving $1 per paycheck, by building this habit you’ll b able to start saving a lot more in the future.

Your income is not your fortune, but you can build a fortune with your income if you learn how save and invest properly. The pain that comes from the discipline of saving and investing pale in comparison with the pain that comes from being broke. You can believe that.

You can visit our website at www.financialworkout101.com for great saving tips.

04/04/2015

Ludvy Joseph, MBA

President/CEO